Benefits Monthly Minute

The May Monthly Minute highlights litigation wins for plan fiduciaries in a 401(k) fee case and a wilderness therapy exclusion case, and also sets out the 2025 HSA, HDHP, and excepted benefit HRA COLA adjustments.

Prudence (not Preference) Prevails in 401(k) Plan Fee Case

In Moore v. Humana, 2024 BL 177578 (W.D. KY 2024), class action plaintiffs sued Humana in 2021, claiming that Humana’s 401(k) plan recordkeeping fees were excessive. Plaintiffs argued that Humana should have negotiated lower fees during the contract term, notwithstanding the fact that defendants engaged in RFPs and annual benchmarking to confirm the reasonableness of plan fees. Plaintiffs also took issue with the plan’s lack of a “fee policy statement.” In rejecting these claims, the Kentucky district court unequivocally stated that ERISA does not require a fee policy statement, nor was the absence of such a statement shown to have any effect on the plan’s recordkeeping fees. The court also pointed out that ERISA imposes no explicit duty to attempt to negotiate a lower fee during the contractual period. Rather, defendant’s method -- using RFPs and annual benchmarking – to ensure that fees remained reasonable, was a responsible method, consistent with industry practice, and evidence of a prudent process. In addition, the court found that plaintiffs failed to demonstrate any dispute of fact as to whether the recordkeeping fees were excessive relative to the services provided given the fees produced the lowest cost to the plan of any candidates solicited via the RFPs, and the annual benchmarking revealed the plan's fees were still reasonable.

KMK Comment: Since most fee litigation cases are settled out of court, plan fiduciaries rarely gain insight as to what might guide a court’s decision. The Humana case shows what a court may consider to be appropriate fiduciary conduct by offering specific examples of prudent actions. For this reason, not only is this case a win for plan fiduciaries, the full opinion is recommended reading for retirement plan fiduciaries.

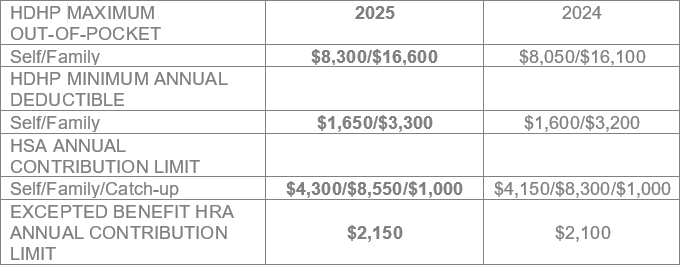

2025 HSA, HDHP, and Excepted Benefit HRA Limits

In Revenue Procedure 2024-25, the IRS provides the 2025 inflation adjusted limits for HSAs, excepted benefits HRAs, and HDHPs. As noted below, all of the limits have increased from 2024 to 2025, except for the HSA catch-up contribution which remains steady at $1,000.

Court Not Wild About Wilderness Therapy Coverage

A Utah district court recently upheld the application of Cigna’s wilderness therapy exclusions in a self-funded plan and a fully-insured plan. In S.F. v Cigna, 2024 WL 1912359 (D. Utah 2024), participants enrolled in outdoor youth programs licensed to provide comprehensive inpatient treatment for mental health and substance use disorders. Cigna, as TPA for both plans, denied coverage based on the plans’ experimental/investigational exclusion. In support of its denials, Cigna relied on the Complementary and Alternative Medicine (“CAM”) policy, a publicly available medical coverage policy which indicated that the efficacy of wilderness therapy has not been established. In its motion to dismiss, Cigna argued that plaintiffs’ failure to seek a second level appeal to an independent review organization (IRO) amounted to a failure to exhaust administrative remedies. Plaintiffs’ claimed that the second level IRO appeal process was voluntary due to the plan’s permissive language (using the term “may”, rather than “must”). Interestingly, the court sided with Cigna, noting that “may” does not mean participants may “simply skip the step[.]” In rejecting plaintiff’s claim under the Mental Health Parity and Addition Equity Act of 2008, the court reasoned that both plans excluded any type of care that qualifies as “experimental, investigational, or unproven” in both mental health and medical/surgical contexts, and the CAM policy similarly excluded wilderness therapy and outdoor youth programs in both contexts.

KMK Comment: While wilderness therapy exclusions are fairly common, courts sometimes differ in their support of related claim denials. In upholding the exclusion, this court’s expansive interpretation of ERISA’s exhaustion requirement is unique. Despite the court’s plan-friendly reading of the claims and appeals procedures (as well as the exclusion language and related parity claim), a safer course of action is to review plan documents with counsel to ensure that exhaustion requirements are clearly described.

The KMK Law Employee Benefits & Executive Compensation Group is available to assist with these and other issues.

Lisa Wintersheimer Michel

513.579.6462

lmichel@kmklaw.com

John F. Meisenhelder

513.579.6914

jmeisenhelder@kmklaw.com

Antoinette L. Schindel

513.579.6473

aschindel@kmklaw.com

Kelly E. MacDonald

513.579.6409

kmacdonald@kmklaw.com

Rachel M. Pappenfus

513.579.6492

rpappenfus@kmklaw.com

KMK Employee Benefits and Executive Compensation email updates are intended to bring attention to benefits and executive compensation issues and developments in the law and are not intended as legal advice for any particular client or any particular situation. Please consult with counsel of your choice regarding any specific questions you may have.